Account Transfer Fees Again?

How to avoid them in 1 simple step.

It’s so easy to pay for things with your Visa® Debit Card, you might not realize how quickly those withdrawals add up. Suddenly, there’s no money left in your CAP COM Checking Account – and that’s the account your Debit Card accesses for money!

So, your Savings Account comes to the rescue. If you have enough money in your Savings Account, an automatic transfer is made to your Checking Account to cover the purchase. This automatic transfer does come at a price.

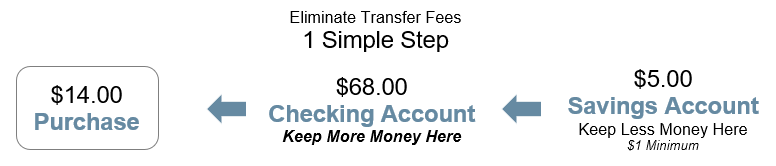

Let’s see an example, shall we? Here’s what happens if you make a $14.00 purchase with your Debit Card but have only $11.00 in your Checking Account.

The thing is…that $1.00 transfer fee is charged each time this happens. Even though CAP COM’s fees are among the lowest around, why pay them if you don’t have to? Sure, you could do your best to keep track, transfer money, time it right. But, there’s a better way.

One simple step. Keep money in your Checking/Spending Account with plenty of buffer to avoid transfer fees. That’s it. Try to build up to at least one month’s expenses to cover your spending. If you have more, you can move it to your Savings Account – or just keep it where it is.

Pro Tip! Unsure how much money is left in your account? Don’t stress. Set alerts in your CAP COM app and you’ll get a friendly reminder when your balance is running low.

1. Tap ![]() at the top of your screen.

at the top of your screen.

2. Select Push Notifications.

3. Toggle Low Balance to ON and set the amount.

Our favorite financial tip of all? Get in the habit of checking your balance – say, as you sip your morning coffee. Knowing how much you have in your accounts puts you in control, and you can also keep an eye out for unusual activity to protect yourself against scams.

Finally, explore two other overdraft options offered by CAP COM besides the automatic transfer with the $1.00 fee.

Be sure to compare eligibility, and the pros and cons of each solution, before making any changes.

Happy banking!