Direct Deposits to Your CAP COM Account

Get Your Money Faster with Direct Deposit

When you expect money to arrive, it can be frustrating to wait for a check to come in the mail. Whether it’s a tax refund, payment for work you’ve done, or your monthly Social Security benefit – sooner is always better than later!

Speed up the process by arranging direct deposits into your CAP COM account. Here are the benefits of direct deposit and the information you’ll need to provide to whoever is paying you.

About Direct Deposit

Direct deposit enables you to receive money directly in your CAP COM account so you can eliminate the delays, clutter, and hassles of paper checks. Below are some ways you can benefit from direct deposit – and keep reading for the information you’ll need to set it up.

Getting Paid. If your employer offers payroll deposit, you can arrange for it to be automatically deposited into your account at CAP COM. Ask your employer how to sign up for payroll deposit and specify which CAP COM accounts you want your payroll deposited into (more on that below).

Your Tax Refund. When you submit your tax return to the IRS, you can have your refund deposited into your CAP COM account. Include the account information requested, so the IRS can automatically make the deposit.

Account Information You’ll Need

You can designate any CAP COM account for your direct deposit – checking, savings, even iSave certificates because they allow deposits. When you set up direct deposit, you can expect to be asked for two pieces of information.

1) CAP COM’s Routing Number

CAP COM’s 9-digit routing number is 221373273. This number identifies the financial institution to the payer, so the funds can be electronically transmitted.

Where to find it? CAP COM’s routing number is:

-

Listed at the bottom of www.capcomfcu.org

-

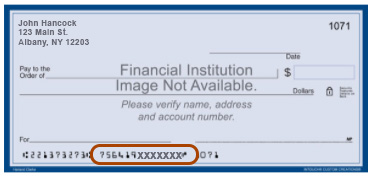

Inside the left set of brackets at the bottom of your checks

-

Under Account Details in your online account

2) Your Account Number

Your 13-digit account number (known as MICR*) specifies the destination for your deposit once it arrives at CAP COM.

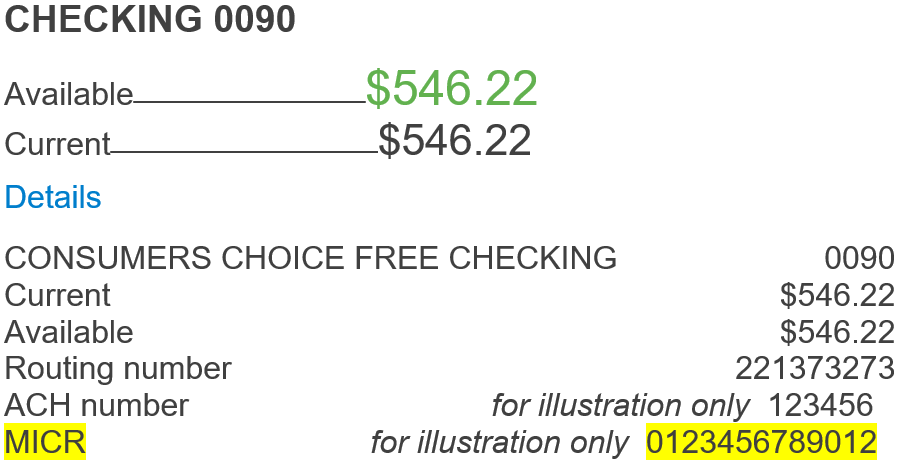

Where to find it in the mobile app?

Locating your account number in your mobile account is easy. Launch your CAP COM app and:

1) Choose the account you want to use for your direct deposits from the list of accounts.

2) Tap Details and note the MICR – this is your 13-digit account number.

Where to find it in your online account?

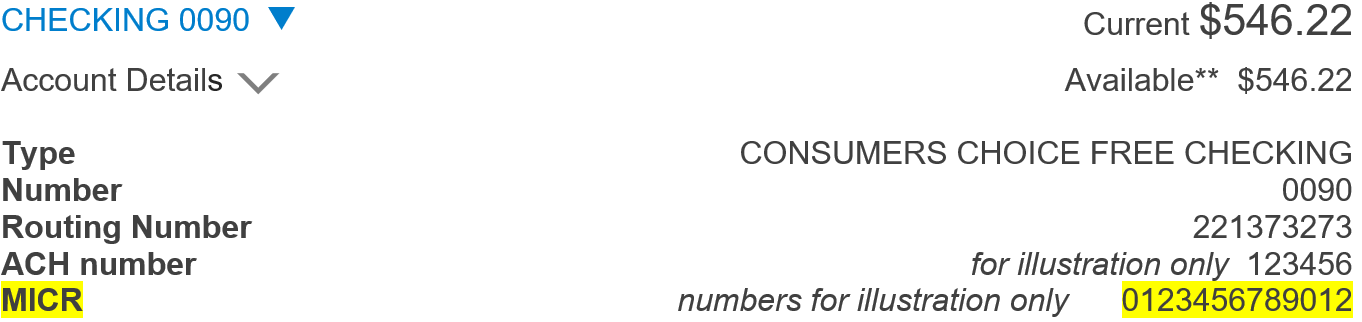

To locate your account number in your online account (desktop):

1) Log in to online banking.

2) Choose the account you want to use for your direct deposits from the list of accounts.

3) Select Account Details.

4) Note the MICR, your 13-digit account number.

Want direct deposit to go into your checking account? Your checking account number is easy to find. See the numbers inside the middle set of brackets at the bottom of your checks.

Free Resource: ClickSWITCH

Did you know you can switch your direct deposits coming into accounts at other financial institutions to your accounts at CAP COM – in just a few clicks? ClickSWITCH is a free service provided to CAP COM members that helps you save time and streamline your finances.

From your secure dashboard in CAP COM’s online banking or mobile app, you can submit requests to move direct deposits (payroll, Social Security, etc.) or automated payments to your CAP COM account.

Related Topics

How to Deposit Checks with Your Phone

How to Order Checks Online

ClickSWITCH Benefits

*MICR stands for Magnetic Ink Character Recognition